Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

StartUp

US science couldn't flourish without an educational system that funnels talented individuals into graduate programs. ....

- Details

- Category: Startup World

Read more: Trump’s 2026 budget proposal: Crippling cuts for science across the board

Write comment (100 Comments)

, asking for just 12 percent of sales on its then-new Epic Games Store. ....

- Details

- Category: Startup World

Read more: Epic Games Store completely eliminates revenue fees for smaller developers

Write comment (95 Comments)

have had almost no significant impact on overall wages or employment yet, despite rapid adoption in some workplaces. ....

- Details

- Category: Startup World

Read more: Time conserved by AI balanced out by new work produced, study recommends

Write comment (96 Comments)

CONCORD, N.C.—We weren't allowed cameras past the lobby of General Motors' shiny new Charlotte Technical Center. It's the automaker's new motorsport hub in the heart of NASCAR country, but the 130,000-square-foot (12,000 m2) facility is for much more than just stock cars....

- Details

- Category: Startup World

Read more: NASCAR, IMSA, IndyCar, F1: GM’s motorsport boss explains why it goes racing

Write comment (95 Comments)

on the social media site X after Schmidt's remarks. ....

- Details

- Category: Startup World

Read more: Eric Schmidt apparently bought Relativity Space to put data centers in orbit

Write comment (100 Comments)

These sorts of adversary-in-the-middle attacks have grown increasingly common. ....

- Details

- Category: Startup World

Read more: Why MFA is getting easer to bypass and what to do about it

Write comment (95 Comments)

We're on the verge of being screwwormed. ....

- Details

- Category: Startup World

Read more: Screwworms are coming-- and they're just as scary as they sound

Write comment (100 Comments)

In a new blog post, DJI shared how DJI’s Dock drone-in-a-box system served as a “blueprint” for future citywide disaster response. Another reason how drones are doing the world good, saving lives, and keeping communities safe.

The city of Asheville, North Carolina, partnered with Ovrwatch, a provider of drones, pilots, and solutions for pretty much...- Details

- Category: Startup World

Read more: How drones transformed Asheville’s disaster response

Write comment (97 Comments)This study likewise calls out LM Arena for what seems much higher promo of personal models like Gemini, ChatGPT, and Claude. ... This research study also calls out LM Arena for what appears to be much higher promotion of personal designs like Gemini, ChatGPT, and Claude. Developers gather data on model interactions from the Chatbot Arena API, but groups focusing on open models consistently get the brief end of the stick.The researchers explain that specific designs appear in arena faceoffs much more frequently, with Google and OpenAI together representing over 34 percent of collected model data. Companies like xAI, Meta, and Amazon are also disproportionately represented in the arena. Those firms get more vibemarking data compared to the makers of open models.The research study authors have a list of suggestions to make LM Arena more reasonable. Several of the paper's suggestions are aimed at correcting the imbalance of privately tested industrial models, for example, by restricting the variety of models a group can include and pull back before launching one. The research study likewise recommends revealing all model results, even if they aren't final.However, the website's operators disagree with some of the paper's methodology and conclusions. LM Arena points out that the pre-release screening features have not been kept secret, with a March 2024 blog post including a quick explanation of the system. They also compete that design developers don't technically select the version that is revealed. Rather, the website merely doesn't show non-public variations for simpleness's sake. When a developer releases the final version, that's what LM Arena contributes to the leaderboard. Proprietary designs get out of proportion attention in the Chatbot Arena, the study says. Credit: Shivalika Singh et al. Exclusive models get disproportionate attention in the Chatbot Arena, the study states. Credit: Shivalika Singh et al. One location the 2 sides may discover alignment is on the question of unequal matchups. The research study authors call for fair sampling, which will make sure open models appear in Chatbot Arena at a rate similar to the likes of Gemini and ChatGPT. LM Arena has actually recommended it will work to make the tasting algorithm more varied so you don't always get the big industrial designs. That would send more eval data to little gamers, providing the chance to improve and challenge the huge business models.LM Arena recently revealed it was forming a corporate entity to continue its work. With money on the table, the operators require to guarantee Chatbot Arena continues figuring into the advancement of popular designs. It's uncertain whether this is an objectively better way to examine chatbots versus academic tests. As individuals vote on vibes, there's a genuine possibility we are pressing designs to embrace sycophantic tendencies. This might have assisted nudge ChatGPT into suck-up territory in current weeks, a move that OpenAI has actually hastily gone back after widespread anger.

- Details

- Category: Startup World

Read more: Brand-new research study implicates LM Arena of video gaming its popular AI benchmark

Write comment (94 Comments)

SEER outlines its digital architecture for manufacturing and logistics. Source: SEER Robotics

In the transformation toward smart factories, the efficient optimization of digital system software has become a key factor in the successful deployment of intelligent equipment like robotics. More and more enterprises are recognizing the core...

- Details

- Category: Startup World

Read more: SEER Robotics offers digital product matrix

Write comment (94 Comments)—of a purple dragon wearing a suit and tie.

(PDF) that prominently featured the aubergine wyrm....

- Details

- Category: Startup World

Read more: Don’t watermark your legal PDFs with purple dragons in suits

Write comment (96 Comments)

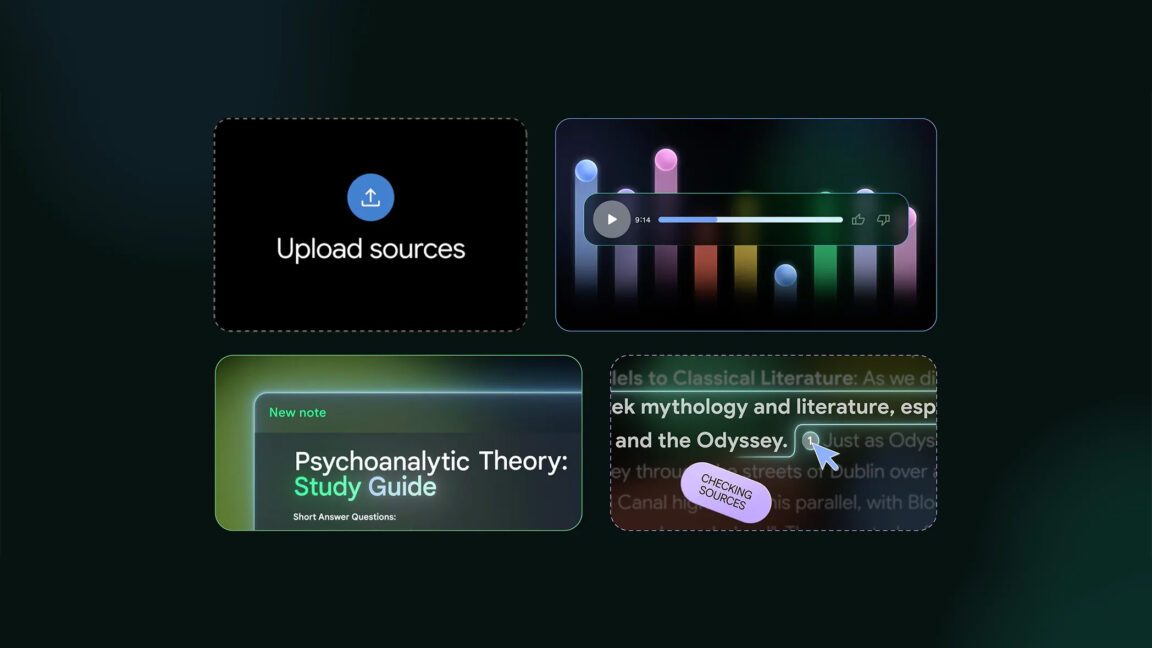

After several years of escalating AI hysteria, we are all familiar with Google's desire to put Gemini in every one of its products. ....

- Details

- Category: Startup World

Read more: Google teases NotebookLM app in the Play Store ahead of I/O release

Write comment (94 Comments)

Waymo robotaxis operate in Austin and other cities, and it is looking at personally owned vehicles with Toyota. Source: Waymo

Toyota Motor Corp. and Waymo LLC this week said they have agreed to explore a collaboration focusing on accelerating the development and deployment of autonomous vehicle technologies. Woven by Toyota Inc., the mobility...

- Details

- Category: Startup World

Read more: Toyota, Waymo consider joint development of self-driving passenger vehicles

Write comment (99 Comments)

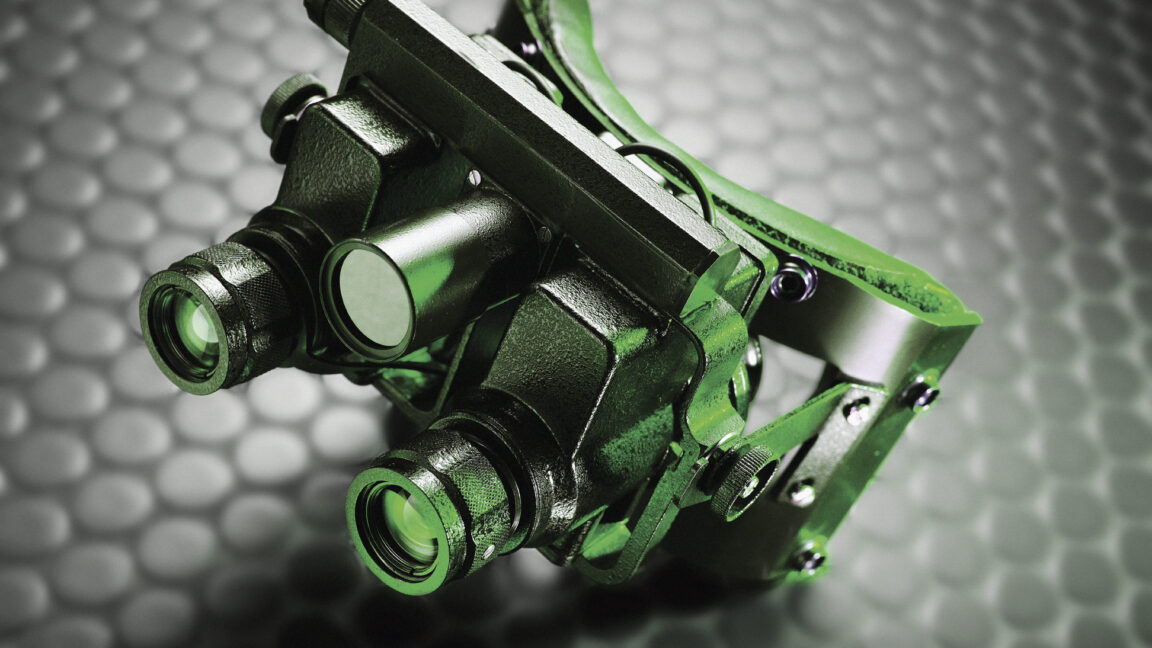

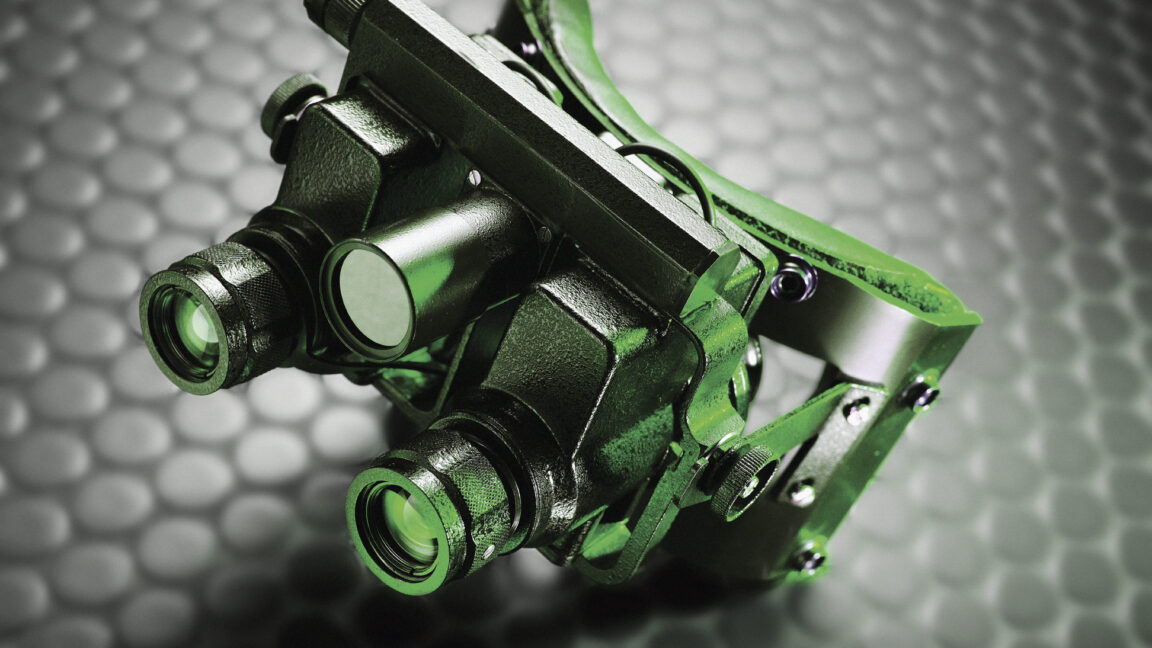

One way to do that is called remote epitaxy, where an intermediate layer made out of graphene or other material is introduced between the substrate and the growing crystals. ....

- Details

- Category: Startup World

Read more: New material might assist us construct Predator-style thermal vision specs

Write comment (95 Comments)

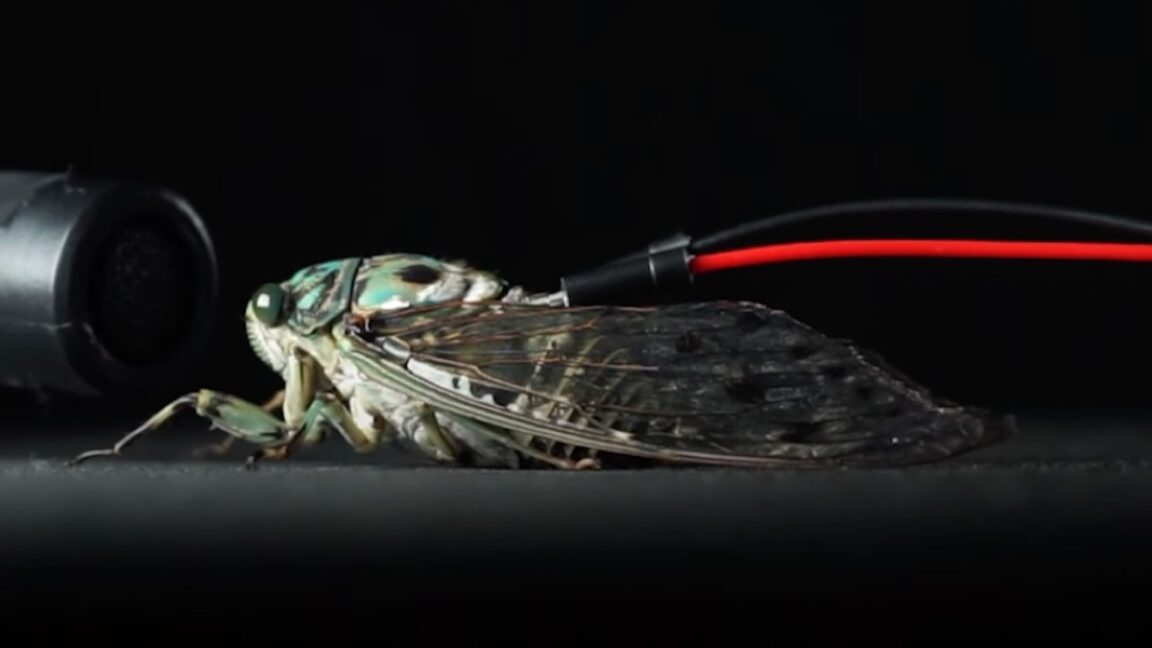

. ....

- Details

- Category: Startup World

Read more: Cyborg cicadas play Pachelbel's Canon

Write comment (99 Comments)

Chang Robotics has worked with Kodiak Technologies on what it said is the most powerful electric snow-removal vehicle developed to date. Source: Matthew Chang, via X

After accomplishments including doubling its workforce in 2024, Chang Robotics this week announced its strategic roadmap for 2025. The company launched a $50 million fund and said it...

- Details

- Category: Startup World

Read more: Chang Robotics announces $50M fund, 2025 strategic roadmap

Write comment (90 Comments)

, a nonprofit, non-partisan news organization that covers climate, energy, and the environment. ....

- Details

- Category: Startup World

Read more: Sen. Susan Collins blasts Trump for cuts to scientific research

Write comment (99 Comments)

"CPB is not a federal executive agency subject to the president’s authority," Harrison said.

PBS President and CEO Paula Kerger went further, calling the order "blatantly unlawful" in a statement provided to Ars....

- Details

- Category: Startup World

Read more: Blatantly illegal : Trump slammed for attempting to defund PBS, NPR

Write comment (94 Comments)

See the Titanium Maestro motion controller at the Robotics Summit - Expo. Source: Elmo Motion Control

With conference and trade show season upon us, robotics developers will have multiple opportunities to learn about Elmo Motion Control Ltd.&s systems, starting with the 2025 Robotics Summit - Expo on April 30 and May 1.

The Petah...

- Details

- Category: Startup World

Read more: Elmo Motion Control presents innovation innovations at upcoming programs

Write comment (100 Comments)

The new infotainment human-machine interface was a little confusing at first; pairing my phone took about 10 minutes but worked out in the end, and wireless Apple CarPlay behaved itself throughout the week. ....

- Details

- Category: Startup World

Read more: The 2025 Aston Martin Vantage: Achingly beautiful and thrilling to drive

Write comment (93 Comments)

Those genes associated with metabolism were upregulated, meaning they showed an increase in activity. ....

- Details

- Category: Startup World

Read more: Some flies go insomniac to ward off parasites

Write comment (90 Comments)

Apple and Anthropic are teaming up to build a “vibe-coding” software platform that will use generative AI to write, edit, and test code for programmers, Bloomberg reported on Friday.

The iPhone maker is planning to roll out the software internally, according to Bloomberg, but hasn’t decided if it will launch it publicly. The system is a new version...

- Details

- Category: Startup World

Read more: Apple and Anthropic reportedly partner to build an AI coding platform

Write comment (91 Comments)

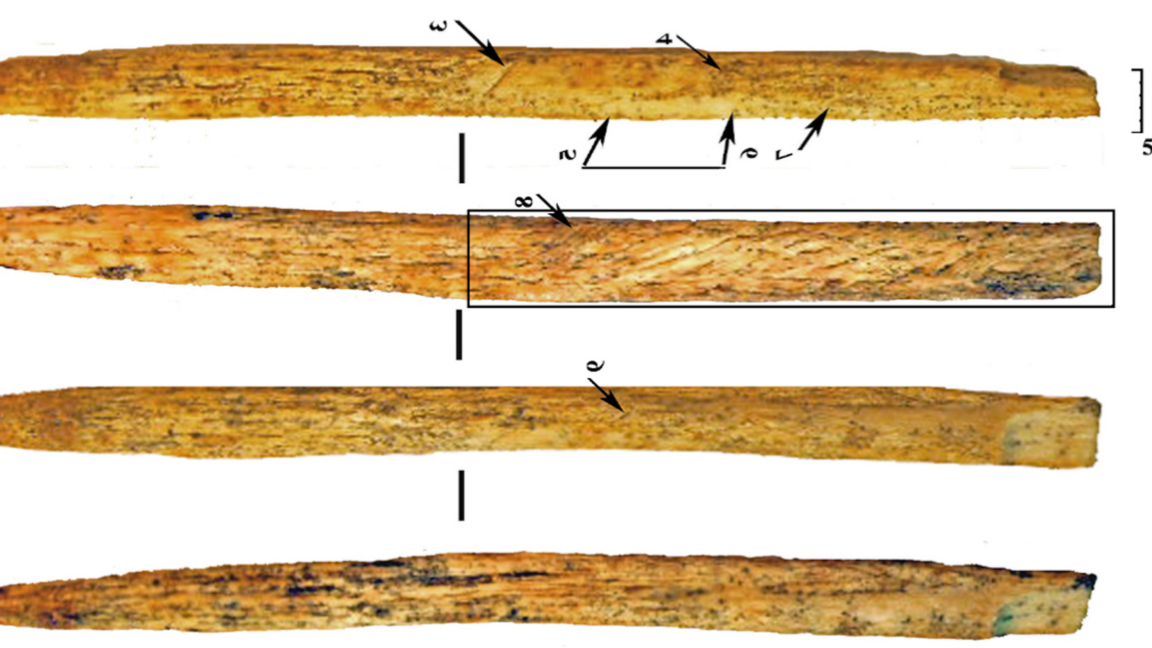

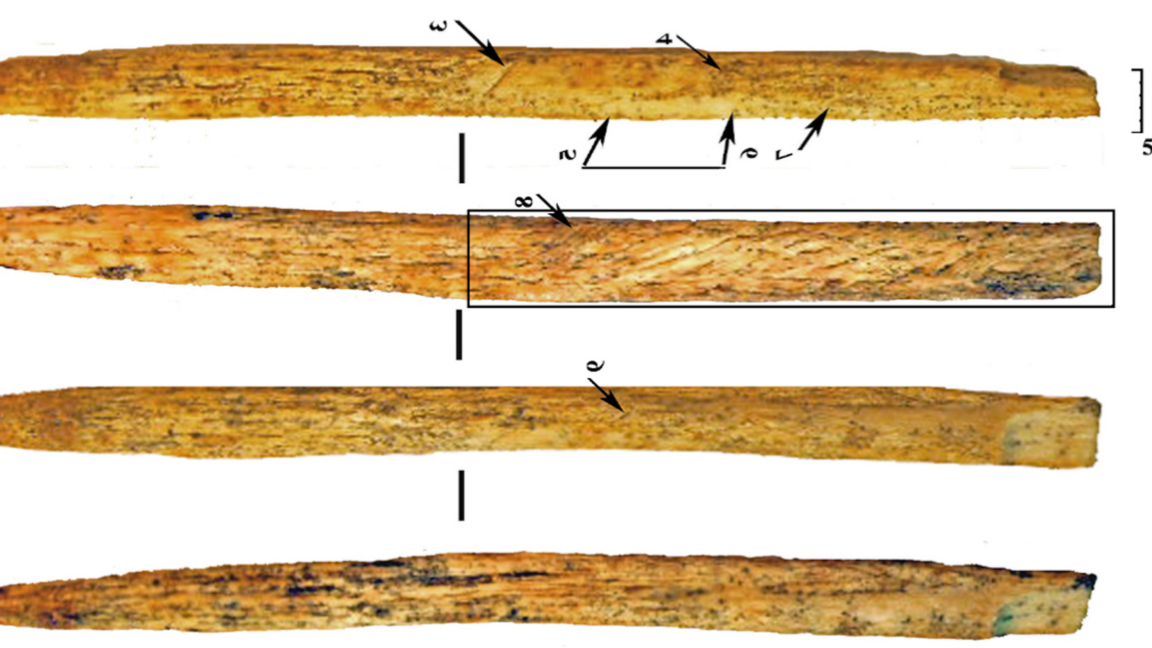

Working bone into a streamlined, aerodynamic spear point, then hafting it onto a shaft with tar that had to be extracted and refined before use takes some sophisticated knowledge and skill. ....

- Details

- Category: Startup World

Read more: Neanderthals invented their own bone weapon innovation by 80,000 years earlier

Write comment (97 Comments)

Several sources in the space community, therefore, believe it is indeed plausible that SLS and Orion will be phased out over the next five years in favor of far less expensive commercial rockets and spacecraft. ....

- Details

- Category: Startup World

Read more: White House budget seeks to end SLS, Orion, and Lunar Gateway programs

Write comment (90 Comments)Invite to Startups Weekly-- your weekly recap of everything you can't miss from the world of startups. Want it in your inbox every Friday? Sign up here.This week was short on M&A and IPO news, but there was still some drama to follow, if that's your thing-- and more importantly, some worthy startups getting funded.Most interesting start-up ...

- Details

- Category: Startup World

Read more: Startups Weekly: Drama or game-changer You decide

Write comment (91 Comments)

Google has built an enormously successful business around the idea of putting ads in search results. ....

- Details

- Category: Startup World

Read more: Google is silently checking advertisements in AI chatbots

Write comment (98 Comments)

at the heart of Apple's sudden changes. ....

- Details

- Category: Startup World

Read more: Spotify seizes the day after Apple is forced to allow external payments

Write comment (98 Comments)

What if cheating was just…the future of work? That’s the pitch behind Cluely, the viral AI startup that claims its stealthy browser overlay is “undetectable” and can help users bluff their way through everything from job interviews to exams. The company has raised $5.3 million and sparked a wave of backlash from startups building tools to catch...

- Details

- Category: Startup World

Read more: Damn, the Cluely ragebait got us

Write comment (95 Comments)

to poach top journalists from popular gaming blogs like Kotaku, Joystiq, and The Escapist. ....

- Details

- Category: Startup World

Read more: Gaming news site Polygon gutted by massive layoffs amid sale to Valnet

Write comment (98 Comments)Page 34 of 89

16

16