Music

Trailers

DailyVideos

India

Pakistan

Afghanistan

Bangladesh

Srilanka

Nepal

Thailand

Iraq

Iran

Russia

Brazil

StockMarket

Business

CryptoCurrency

Technology

Startup

Trending Videos

Coupons

Football

Search

Download App in Playstore

Download App

Best Collections

StartUp

Earlier this week, the Equity crew caught up with Work-Bench investor Jon Lehr to get his take on the current market, and how his firm goes about making investment decisions.

The conversation was a treat, so we cut a piece of it off for everyone to listen to. The full audio and a loose transcript are also available after the jump.

What did Danny and

- Details

- Category: Startup World

Read more: Chatting venture, B2B and thesis-driven investment with Work-Bench's Jon Lehr

Write comment (91 Comments)

Phos, the U.K. fintech that offers a software-only PoS so that merchants can accept payments directly on their phones without the need for additional hardware, has raised €1.3 million in funding. The round was led by New Vision 3, an early-stage VC based in Bulgaria (where a part of the Phos team is based), with participation from a number of u

- Details

- Category: Startup World

Read more: Phos, the UK fintech that provides a software-only POS for smart devices, raises EUR1.3 M

Write comment (92 Comments)

Voice-based social networks and gaming as a new form of identity were among the top emerging trends in consumer social startups, according to an Extra Crunch survey of top social tech investors. Meanwhile, anonymity and dating apps with a superfluous twist were spaces where investors were most pessimistic.

Extra Crunch assembled a list of the most

- Details

- Category: Startup World

Read more: Investor survey results: Upcoming trends in social startups

Write comment (92 Comments)A new startup called twine wants to help people feel less isolated and alone. Though the project has been in the works for around six months, it’s launching at a time when people are struggling with being cut off from family, friends, neighbors, co-workers and others due to the COVID-19 outbreak and the resulting government lockdowns and s

- Details

- Category: Startup World

Read more: Twine aims to end social isolation with its video chat app for deep conversations

Write comment (100 Comments)

MyBuddy.ai, a startup that develops virtual tools to help kids learn English, announced today that it has raised $1 million in seed funding from LETA Capital. The capital will be used to expand into new markets and develop new features including mini-classes about health.

The San Francisco-based company’s app features a AI-based virtual tutor c

- Details

- Category: Startup World

Read more: MyBuddy.ai, a virtual tutor for youngsters discovering English, elevates $1M seed round

Write comment (90 Comments)Early this afternoon Shippo, a shipping software application and also services firm, announced that it has actually shut a $30 million Collection C. The funding round roughly increases the funding that the company has elevated to-date, from a little over $29 million to simply under $60 million.The round, however, had not been placed together recently. As is frequently the instance with financing e.

- Details

- Category: Startup World

Read more: Shippo elevates a $30M Series C after uploading fast 2019 growth

Write comment (99 Comments)France’s health minister Olivier Véran and digital minister Cédric O have officially announced that the French government is working on a smartphone app to slow the spread of COVID-19. The government is putting a stamp of approval on the Pan-European Privacy-Preserving Proximity Tracing (PEPP-PT) project but remains cautious about what to expect

- Details

- Category: Startup World

Read more: France is officially working on ‘Stop Covid’ contact-tracing app

Write comment (99 Comments)

Neat, a Hong Kong-based fintech startup, announced today that it has raised a $11 million Series A to help small businesses do cross-border banking. The round was led by Pacific Century Group, with participation from Visa and MassMutual Ventures Southeast Asia, and returning investors Dymon Asia Ventures, Linear Capital and Sagamore Investments.

Nea

- Details

- Category: Startup World

The fintech wars continue to heat up with another major exit in the space.

Consumer financial services platform SoFi announced today that it is acquiring payments and bank account infrastructure company Galileo for $1.2 billion in total cash and stock. The acquisition is dependent on customary closing conditions.

Salt Lake City-based Galileo was

- Details

- Category: Startup World

Fintech startups were hot news before the COVID-19 era, but the pandemic hasn’t bumped the sector out of the headlines.

Companies that were pitching optimistic news a few weeks ago are now cutting staff. Others are facing a surge of users trying to find their financial footing in the face of uncertainty. Some fintech shops are sharing data by the

- Details

- Category: Startup World

Read more: Fintech's irregular new reality has assisted some start-ups, hurt others

Write comment (95 Comments)

Tyto Care, the provider of a home health diagnostic device and telemedicine consultation app, said it has raised $50 million in a new round of funding.

The round was led by Insight Partners, Olive Tree Ventures, and Qualcomm Ventures, according to a statement, and brings the startup’s total capital raised to more than $105 million.

The funding

- Details

- Category: Startup World

After raising $8 million in November to roll up top Amazon marketplace companies, the new Boston-based startup Perch has begun putting that money to work in its first few deals.

The brainchild of Chris Bell, formerly Wayfair’s head of logistics and a Bain - Co. principal, Perch is well-positioned to serve as unifier of a bevy of disparate

- Details

- Category: Startup World

Embellishment, started by Twitter graduates Deepak Rao in addition to Siddharth Batra, wishes to money student expenditures by taking a look at work deal letters as a means to assess auto loan. Today, it introduced its money system along with is offered to students on over 400 colleges throughout 31 states.The San Francisco service helps underfunded students, a team that isn't typically a.Thrive, started by Twitter graduates Deepak Rao as well as Siddharth Batra, intends to money trainee costs by looking at job deal letters as a way to assess fundings. Today, it introduced its financing platform and also comes to pupils on over 400 schools across 31 states.The San Francisco company helps underfunded trainees, a team that isn't commonly accounted for by standard financial establishments that issue finances based upon credit scores score. According to co-founder Rao, Thrive is for people like first-generation Americans, people that originate from low-income households, or first-generation pupils. Prior to releasing generally, Grow secured$10.25 million in funding and also $5 million in endeavor financial obligation. Today, the company also revealed that it has gotten a$200 million credit score line from Credit report Suisse.Investors consist of Max Levchin, owner of PayPal and Affirm; Adam Bain, former COO of Twitter; as well as David Sacks, a general companion at Craft Ventures. We started the company with the goal to buy human potential, Rao stated. We generally developed an item that encourages underfunded pupils as well as offers them accessibility to funds for whatever things they require in order to change into their expert lives. The cash money can be used flexibly for items like brand-new laptop computers or flights home.Students can sign up on the platform and also submit a deal letter for an approaching summer season internship or full-time college postgraduate deal. Grow confirms the file, then offers a financing to the students.For a teaching fellowship, Flourish unlocks 25%of the trainee's complete internship salary for a lending. For a permanent job, Thrive will certainly offer 25%of an individual's very first three months'salary.Thrive fees trainees between $7 to$15 per every$1,000 they obtain per month, and also they're allowed to take as much as they need from the dollar quantity that Flourish provides them. If you take $1,000 and your teaching fellowship starts in three months, and also if you want to pay it back in one go, you have to pay between$21 to $45 above the$1,000 when you pay it back.Once pupils confirm they're quickly going to be utilized, they can access the funds within one company day and also after that begin paying back Thrive once they start their brand-new job.Thrive's payback structure resembles the income-sharing layout that a firm like Lambda Institution uses. Lambda Institution states it offers students the option to pay no bucks for tuition, as well as after that pay 17% of their salary they make from a task that pays a minimum of$ 50,000 every year for two years.So while it's not brand-new to bank on salary, Thrive is checking out transforming the idea of inbound sharing on its head and also applying it to finance financing.When they founded the company in 2017, Rao and also Batra were both classmates at Stanford and afterwards colleagues at Twitter. Rao originates from a low-income family, so he personally really felt the impact of prices that come with being a college student in the United States, from flying house to spending for your laptop computer. Or simply even dinner.Thrive decreased to share specific financials or discuss profitability. Rao did state that the business is expanding 5 times year over year and also has enough funds to stay clear of increasing equity capital till completion of 2021. Our biggest expenditure is the capacity to fund car loans, and also we are not moneying loans through equity cash, Rao claimed. At the end of the day, it's like a software company, our largest price is the price of items, which is resources, as well as a person else is funding the resources. Not needing even more equity capital could be especially useful as we enter a time of financial uncertainty due to COVID-19. Unlike various other fintech firms, which have had to tighten their underwriting requirements to plan for threat because of the uncertain economy, Rao informs TechCrunch that Thrive will not transform exactly how willing they are to compose loans.Some tech teaching fellowships have been terminated due to COVID-19, he kept in mind, and also if trainees have had an offer retracted, Thrive updates the layaway plan accordingly. As long as your teaching fellowship is still active, your deal is still released, he stated. That doesn't matter whether the intern will be remote or in-person. Grow is broadening its organisation as undergraduate and also graduate pupils are going into a job market with traditionally high unemployment. We'll see exactly how a tough work market influences a company that depends on deal letters for car loans, as well as whether their bank on alternate financing settles.

- Details

- Category: Startup World

Last valued at $5 billion, restaurant management platform Toast has joined the sweep of startups laying off employees due to the economic impact of the COVID-19 pandemic. Toast reduced the size of its staff by 50% through layoffs and furloughs, according to a blog post from Toast’s CEO, Chris Comparato. It also reduced executive pay across the b

- Details

- Category: Startup World

Read more: Restaurant management platform Toast cuts 50% of staff

Write comment (100 Comments)

Securitization is a critical function of the modern financial system. Banks “package” individual loans, say a mortgage or an auto loan, into a group with similar characteristics and sell them to other investors. That gets the debt off the originator’s balance sheet so that they can offer more loans, while also offering private investors alter

- Details

- Category: Startup World

Read more: Securitization platform Cadence surpasses $125M deal volume and raises $4M

Write comment (97 Comments)

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

So far, 2020 has proven to be a year of surprises and disappointments. Over the past month, we’ve seen companies like Toast go from raising huge new rounds this year at heightened valuations to layoffs in mere months. TripActions is

- Details

- Category: Startup World

Read more: Owner concerns improve as capitalists pump the brakes

Write comment (92 Comments)A number of startups over the years have promised to re-invent email only to have fallen short. Even Google’s radical re-imagining, the Inbox app, finally closed up shop last year. Today, another company is announcing its plans to build a better inbox. Edison Software is preparing to launch OnMail, a new email service that lets you control who

- Details

- Category: Startup World

Read more: New email service, OnMail, will let recipients control who can send them mail

Write comment (92 Comments)

CircleCI, an early adherent to the notion of continuous delivery when it launched in 2011, announced a $100 million Series E investment today. It comes on top of a $56 million round last July.

The round was led by IVP and Sapphire Ventures. Under the terms of the deal, Cack Wilhelm will be joining the CircleCI board. Jai Das from Sapphire will

- Details

- Category: Startup World

Read more: Constant delivery leader CircleCI scores $100M Collection E

Write comment (100 Comments)Chance's a hot money, as well as every early-stage startup founder's looking for it. Anything as well as everything that can aid bring the desire to fruition, right? You'll find 3 days packed with opportunity at TechCrunch Disrupt San Francisco 2020 on September 14-16. Treatment to know how you can super-size your Disrupt opportunity?We'll get to t.

- Details

- Category: Startup World

Read more: Apply today to be a TC Top Select at Disrupt SF 2020

Write comment (97 Comments)

Here’s another edition of

- Details

- Category: Startup World

Read more: Dear Sophie: Is unemployment considered a public benefit

Write comment (93 Comments)

WorkClout, a graduate of the Y Combinator Winter 2019 cohort, announced today that it has shifted its focus from manufacturing automation to manufacturing performance support and has raised a $2.3 million seed round.

The funding was led by Spider Capital with participation from Y Combinator, Liquid 2, Soma Capital, Pioneer Fund, Mehta Ventures and

- Details

- Category: Startup World

The U.K.’s fintech’s response to the coronavirus pandemic so far might best be described as “move fast, [and] make things,” as multiple and sometimes impromptu teams roll out financial technology solutions to help combat the crisis.

Last month, I reported on “Covid Credit,” a project that saw dozens of volunteers from the wider U.K. fintech c

- Details

- Category: Startup World

Read more: Move quickly, make things-- UK fintech's action to the coronavirus crisis continues

Write comment (92 Comments)Relativity Space’s focus on 3D printing and cloud-based software helps it weather the COVID-19 storm

Just like in almost every other industry, there’s been a rash of layoffs among newer space startups and companies amid the novel coronavirus crisis. But Relativity Space has managed to avoid layoffs — and is even hiring, despite the global pandemic. Relativity CEO and founder Tim Ellis cites the company’s focus on large-scale 3D printing and its ad

- Details

- Category: Startup World

Hello and welcome back to our regular morning look at private companies, public markets and the gray space in between.

We’ve dug into churn twice in the last week from an expert and data-based perspective. We’ve also spent a good amount of time talking to venture capitalists about how they are approaching today’s turbulent market.

This morning we’re

- Details

- Category: Startup World

Read more: Just how SaaS startups should plan for a rough Q2

Write comment (98 Comments)Fintech is white hot these days, with major acquisitions and funding rounds galore. It’s also a relatively new space, with startups only really breaching the thicket of regulations that defines the modern banking and finance world in the past few years.

So it is fascinating to watch how Shamir Karkal, one of the original fintech entrepreneurs, is

- Details

- Category: Startup World

Read more: Programmable fintech payments startup Sila raises $7.7M seed to wipe out ACH

Write comment (90 Comments)

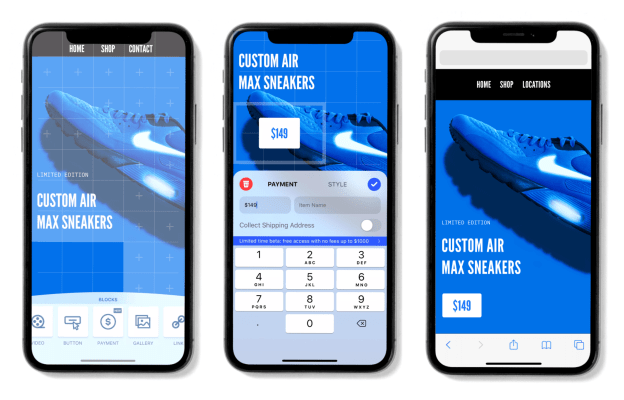

A startup that has framed itself as an Instagram for websites is now squaring up against Shopify as it nabs new funding from Google’s venture capital arm.

Brooklyn-based Universe has just closed a $10 million Series A from GV. The funding round was well in the works before the COVID-19 pandemic took hold stateside; nevertheless, CEO Joseph Cohen

- Details

- Category: Startup World

Read more: Mobile website builder Universe raises $10M from GV as it ventures into commerce

Write comment (93 Comments)

Railsbank, the open banking and compliance platform, has picked up further investment, following the company’s $10 million Series A in September 2019.

This time backing comes from Visa — a strategic investment, if you will — along with Global Brain, a venture capital firm based in Tokyo, Japan. The exact amount isn’t being disclosed, though sourc

- Details

- Category: Startup World

Read more: Visa backs open banking and compliance platform Railsbank

Write comment (96 Comments)

The coronavirus pandemic has pushed entrepreneurs and investors into unknown territory.

Google’s GV just led a $10 million investment in Universe, a low-friction website builder that’s venturing into the world of commerce.

The investment was in the works before COVID-19 hit America in force, but things were finalized for the Brooklyn startup in

- Details

- Category: Startup World

Read more: GV’s M.G. Siegler on portfolio management, crisis fundraising and his latest investment

Write comment (100 Comments)Today, Utah-based SaaS startup Podium revealed that it has actually shut a $125 million Collection C led by Y Combinator's Connection fund, with engagement from Sapphire Ventures and also Alkeon, as well as Employee Co. Ltd.. Previous capitalists IVP, GV, Top, and Accel additionally participated in the financing event.The brand-new funding values Podium at around $1.5 billion, and also

- Details

- Category: Startup World

Read more: Utah's Platform raises $125M Collection C led by YC after getting to $100M ARR

Write comment (93 Comments)Page 61 of 89

19

19